Overview

As Decentralized Finance (DeFi) has become a hot topic, there have been questions about how OneLedger’s products relate to this newly defined DeFi space.

What is DeFi?

Decentralized Finance is based around financial products that have been created on a blockchain network. Traditional financial instruments like savings accounts, loans, securities and their derivatives and even digital payments can all be attributed to DeFi when completed over a decentralized network.

Why is DeFi a hot topic today?

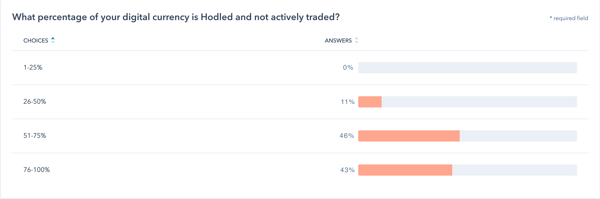

Primarily, due to the interest gained on lending products, with an ROI of up to 8%, DeFi lending surpasses any bond yield, with a similar rate of risk. In a recent survey taken by the OneLedger community, approximately 43% of all token holders are holding, and not trading 75% - 100% of their portfolio, another 46% of the survey takers said they hold 50% to 75% of their portfolio and only 11% actively trade 50% to 75% of their portfolio. If we took a weighted average across these tiers approximately 78% of all tokens are being held and not traded.

Figure 1: Digital Token Consumer Survey Results

Figure 1: Digital Token Consumer Survey Results

According to CMC’s Total Market Capitalization, on July 13 2020, the total digital currency marketcap is $274B+. This would mean approximately $200B worth of digital currency is not being traded and available for alternate DeFi products.

Figure 2: CoinMarket Cap: Total Cryptocurrency Market Capitalization

Figure 2: CoinMarket Cap: Total Cryptocurrency Market Capitalization

But is DeFi really Decentralized?

At the moment, Blockchain networks, digital currencies, and some wallets are totally decentralized, but applications have not caught up yet. The most popular exchanges are centralized, and yes companies are creating Decentralized Exchanges (DEX's), but they are still not the most prominent exchanges. For lending products, most are based on smart contracts, and the logic for the lending is decentralized, but you will always have to go through a centralized mediary, a company or a foundation, that owns the smart contracts and the application built on top of the smart contract. As we shift into this new era of DeFi, it is important to remember that although the logic is becoming decentralized, corporations will still have to exist to provide users with the applications that run on top.

What is OneLedger doing in this space?

For OneLedger, it is important to provide the tools required to generate new applications in DeFi. We have already built a Decentralized Proof of Stake protocol, which has the capability of sustaining itself. Staking in itself is a primary form of DeFi, it provides validators with the ability to lock their tokens and earns them interest on top.

Interoperability for DeFi

Interoperability is another tool that we have created. Our Lynx Engine provides developers with a way to extend our interoperability to multiple digital currency pairs. A DEX leverages those pairs to create swapping capabilities and move away from centralized exchanges. We are currently exploring partnerships, which will extend our network in this way.

Interoperability also enables our payments service, OL Pay. Based on our analysis, approximately 78% of all tokens are not being traded and are being saved, and we are providing them an avenue to spend digital currencies just like a legal tender. OL Pay has 3 components:

- Interoperability to move digital currencies on to our network, which is completed and functional within the OneWallet

- A payments widget for customer websites, which is being worked on

- Marketplaces that accept digital currencies, which is being worked on

Interoperability for FinTech is another major area where our solution helps current banks adopt Blockchain technology. Currently banks trade lending assets, and have attempted to research blockchain technology to manage these assets, but have failed at cross-bank lending. The blockchain networks are private and will always be private for these institutions, which means they require a way to intercommunicate across these institutions. We came across a use case like this with the National Australia Bank (NAB). NAB was trying to connect assets off their balance sheet with a Singapore based bank and was failing at this very use case. Interoperability is key in solving this problem, and bringing institutions like NAB into DeFi.

Asset Management for DeFi

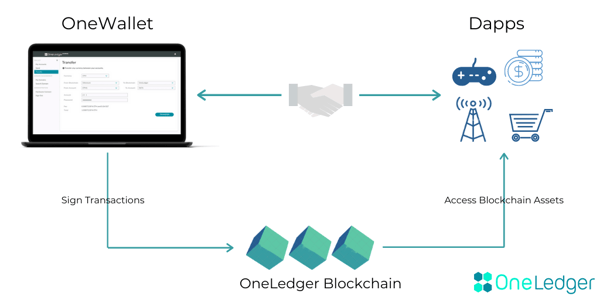

The OneWallet is a fully decentralized custodial wallet for all your digital assets. Using the HD Wallet capabilities, we ensured that we were providing the community with a tool where the only security needed is their 24 word passphrase. We have really gone the extra mile to ensure all of your assets are persisted only on the Blockchain and can only be leveraged through your 24 word passphrase. This is very important as we start scaling our network. Our next phase of Dapps will be integrated all through the OneWallet. So although the application that you’re dealing with may be centralized, the assets and the custody of the assets will be fully decentralized and controlled by you.

Figure 3: Asset Management workflow

Figure 3: Asset Management workflow

This capability then enables developers to create marketplaces where digital assets are traded but the custody is in the OneWallet, leveraged only through your 24 word passphrase, and the asset only lives on the blockchain. This is the exact implementation we used for our Domain Naming Service, which provides the full capability to Buy and Sell Domains. The same feature set can be used for future digital assets, whether they are loans, securities or any of their derivatives. We have also left this functionality open to other digital assets, such as purchase and investment agreements.

Identity Management and KYC/AML

Identity management has always been a hot topic in blockchain, and we believe it is still a very important topic when it comes to DeFi. The reason is, DeFi still needs to be regulated.

Currently governments charge Capital Gains Taxes on all securities in the form of income tax. The emergence of DEX's and other DeFi products will limit all government ability to charge income tax on capital gains or dividend income.

The way OneLedger has managed decentralized identity may be the key to solving this issue. By managing your identity through Domains, governments are one step closer to being able to tie your activity, gains and losses, back to your income.

OneLedger’s Domain Management ties an individual’s or a business’s identity on our network. By associating your domain or subdomain to a trading account or by associating it to a charity's donations account we are enabling government audits for those institutions that require it. We are working with exchanges to see if there is a possibility of incorporating Domains instead of addresses into their ecosystems, and DEX's built on the OneLedger platform can always leverage domains as well. As more applications are built on the OneLedger blockchain, we will promote the use of Domains over account addresses.

As the network grows, we will optionally introduce verified domains where Know Your Customer (KYC) is done for individuals and businesses. Verified domains will serve as a way for people to trust individuals and businesses on our network and as a tool for Anti-Money Laundering (AML), so that governments can conduct their audits freely. Domains and decentralized Identity won’t solve all the AML issues, but it's a step in the right direction to get DeFi regulated.

Final Thoughts

In the future, applications that service DeFi products will somewhat need to be centralized, because businesses will not completely cease to exist and no one developer can build an entire DeFi application. Several people must come together to ensure the working quality of a product, but the underlying assets and network can be decentralized and the custody of those assets can also be completely decentralized. At OneLedger, we are building the decentralized tools that DeFi applications can sit on top of and rely on our network to do the heavy lifting. We will partner and work with developers to build the next generation DeFi applications and provide an area for such marketplaces within our OneWallet, so that the crypto community has full access to these applications.

If you would like to learn more about OneLedger and it's applications, visit our website.